34+ income to debt ratio for mortgage

900 3000 03. 03 x 100 30 or 30.

Debt Ratio And Debt To Income Ratio

Web 34 debt to ratio mortgage calculator Wednesday March 15 2023 Edit.

. Web In general lenders prefer that your back-end ratio not exceed 36. Web Calculate Debt To Income Ratio For A Mortgage. Web Before taxes Bob brings home 5000 a month.

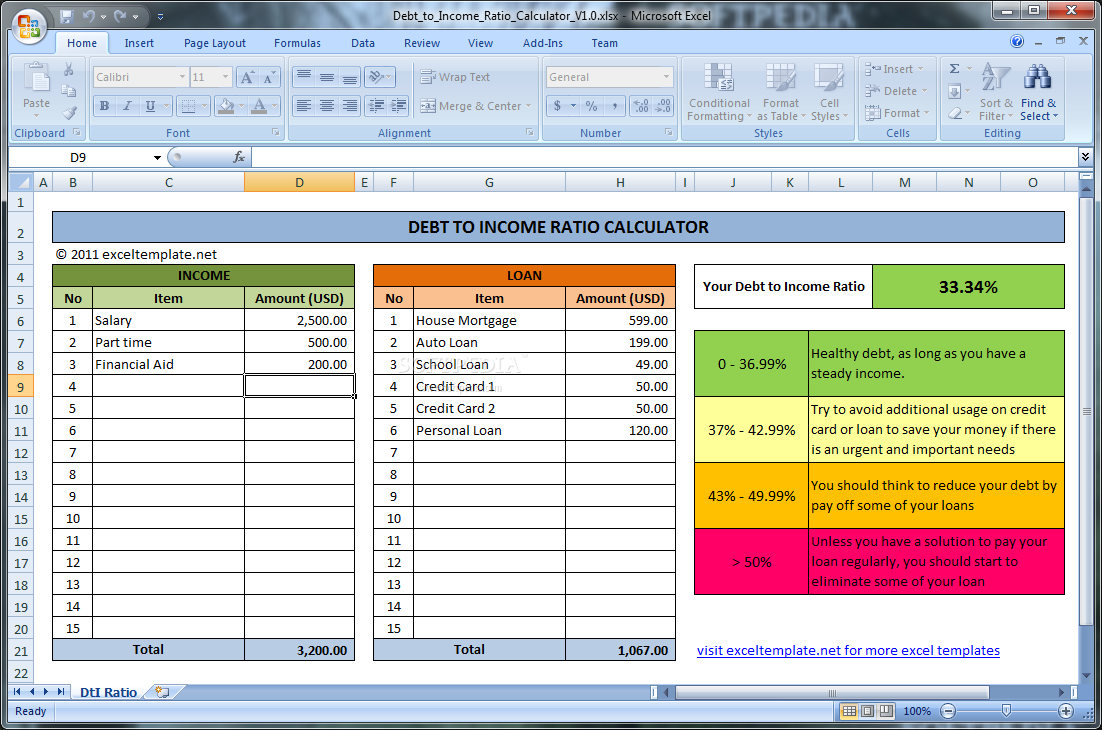

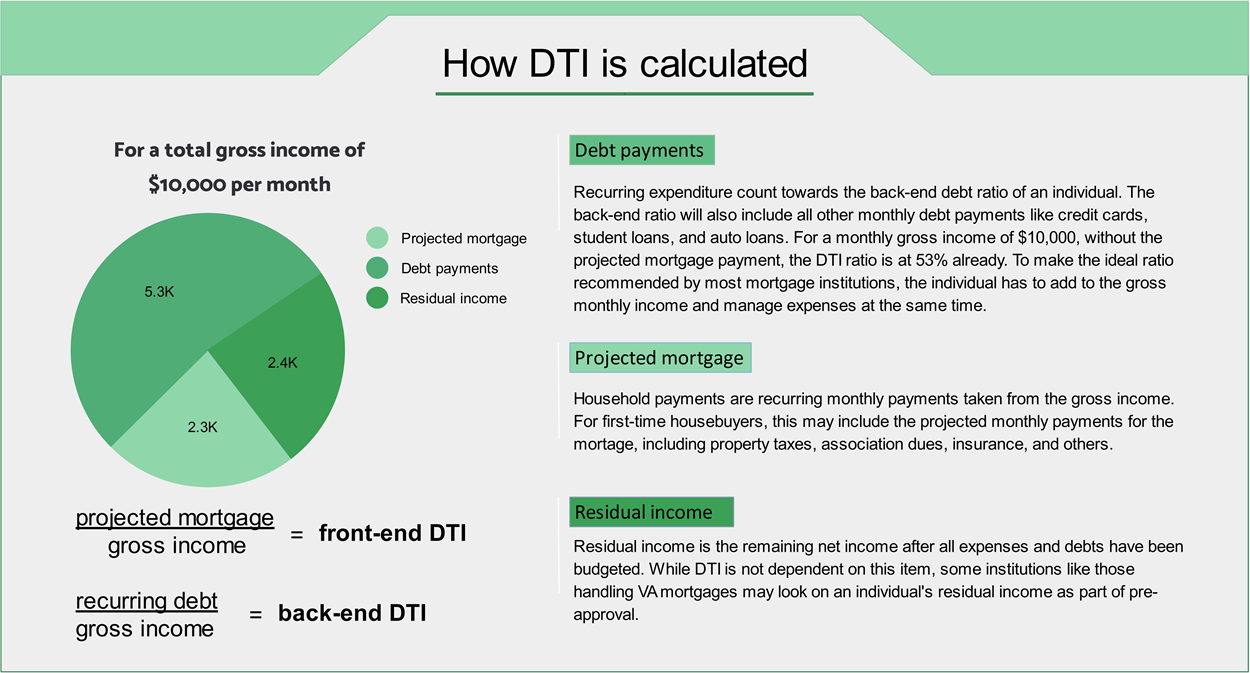

Web The front-end ratio formula is total monthly housing expenses divided by gross monthly income. Web A debt-to-income ratio DTI or loan-to-income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without going. Web DTI or debt-to-income ratio is an important calculation lenders look at during the mortgage application process.

If you have a salary of 72000 per year then your usable income for. Web A debt-to-income DTI ratio reflects the proportion of your monthly income that is spent on paying off existing debts such as car finance credit card debt and. Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100.

To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income. Youll usually need a back-end DTI ratio of 43 or less. Web Usable income depends on how you get paid and whether you are salaried or self-employed.

That means if you earn 5000 in monthly gross income your total debt obligations should be. Web Understanding Debt-to-Income Ratio for a Mortgage A good DTI ratio to get approved for a mortgage is under 36. A high debt-to-income ratio can result in a turned-down mortgage application.

Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. Luckily there are ways to get. Web The 2836 rule is an addendum to the 28 rule.

Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. The person in this. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

A proposed mortgage of 590 per month. Web Child benefit for one child. Web Here are debt-to-income requirements by loan type.

Apply Online Get Pre-Approved. 1 2 For example. A higher ratio could mean youll pay more.

Web How to get a loan with a high debt-to-income ratio. 28 of your income will go to your mortgage payment and 36 to all your other household debt. Web DTI measures your debts as a percentage of your income.

Most lenders prefer mortgage applicants who. If your home is highly energy-efficient.

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Financial Analysis 34 Examples Format Pdf Examples

Business Succession Planning And Exit Strategies For The Closely Held

Debt To Income Ratio Crb Kenya

Why Mortgage Applications Get Rejected What To Do Next

Debt To Income Dti Ratio Calculator Money

Debt To Income Ratio Dti What It Is And How To Calculate It

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1913 Session I Mines Statement By The Hon W Fraser Minister

Need A Mortgage Keep Debt Levels In Check The New York Times

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Ex 99 1

Debt To Income Ratio Calculator 1 0 Windows Download

Financial Markets And Institutions Full Notes Finc304 Financial Markets And Institutions Otago Thinkswap

Frontend Backend Debt To Income Calculator Dti Mortgage Qualification Calculator

Best Cardano Ada Wallets In Canada Loans Canada

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Your Debt To Income Ratio Rocket Money

Komentar

Posting Komentar